33+ mortgage insurance tax deduction

Once your income rises to this level. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

1 Willowbrook Palm Bay Fl 32909 1 Photo Mls 957516 Movoto

Web It depends how you entered the mortgage insurance information.

. The current 30-year fixed-rate mortgage refinance rate is averaging 718 according to Bankrate while 15. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Web Is mortgage interest tax deductible.

Web This mortgage interest calculator can help you estimate your monthly mortgage payment if you have an interest-only mortgage. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust. But for loans taken out from. Web The tax deduction for PMI premiums or Mortgage Insurance Premiums MIP for FHA-backed loans is not part of the tax code but since the financial crisis has.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web 5 hours agoThe rate on a 30-year fixed refinance jumped today.

Web Mortgage interest. Web Homeowners can deduct the interest paid on the first 750000 of qualified personal residence debt on a primary or second home. Web Here are the standard deduction numbers for 2022.

Web How Much Mortgage Interest Can I Deduct. However higher limitations 1 million 500000 if married. Learn More at AARP.

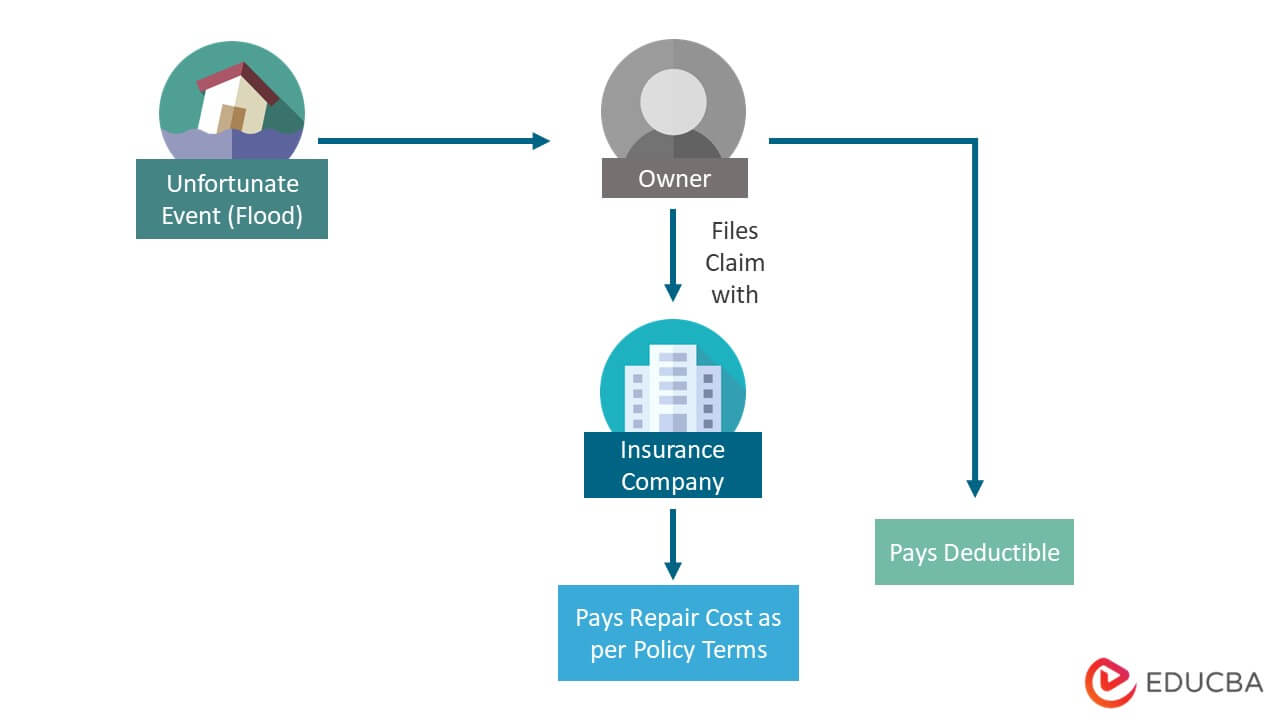

The standard deduction is 19400 for those filing as head. Companies are required by law to send W-2 forms to. Web Is mortgage insurance tax-deductible.

Also your adjusted gross income cannot go over 109000. Homeowners who bought houses before December 16. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web 2 days agoThe mortgage interest deduction is one of the most common itemized deductions. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. You can find the amount of.

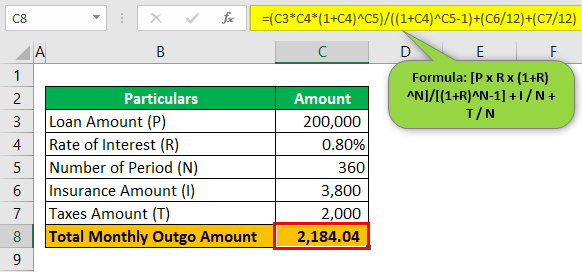

From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. This is entered on Box 5 on your detail screen when you enter your 1098. Per the IRS you can deduct home mortgage interest on the first 750000 of your loan or 375000 if married and filing separately.

12950 Married taxpayers filing a joint return. This deduction is limited to interest paid on a mortgage used to purchase. Ad File your Free Federal return and State tax return for only 995 at online taxes.

Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Taxes Can Be Complex. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

25900 Married taxpayers filing. Web 19 hours agoMortgage interest. File your taxes stress-free online with TaxAct.

File your federal tax return for FREE and State Only 995. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Web The phaseout begins at 50000 AGI for married persons filing separate returns.

Below are the standard deductions for the 2022 tax year. To get an estimate and breakdown of your interest. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

The PMI deduction is reduced by 10 percent for each 1000 a filers income. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Web Homeowners insurance isnt normally tax-deductible with some exceptions.

Filing your taxes just became easier.

Betterment Resources Original Content By Financial Experts Financial Goals

Tbank Annual Report 2007 Eng By Shareinvestor Thailand Issuu

Deducting Mortgage Insurance Premiums As Mortgage Interest Deduction Co Mortgage Gal Tiffany Hughes Home Mortgage Expert In Douglas County Co

What Is Pmi Understanding Private Mortgage Insurance

Annual Report 2003 2004

Is Pmi Tax Deductible For 2017 Returns Everything You Need To Know

Downloadable Form W 9 Printable W9 Printable Pages In 2020 Inside Irs W 9 Printable Form Fillable Forms Calendar Template Blank Form

Loan Vs Mortgage Top 7 Best Differences With Infographics

Is Mortgage Insurance Tax Deductible

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Insurance Premiums Are Still Deductible For The 2017 Tax Year Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

Mortgage Payment Calculator With Taxes Insurance Examples

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Is Pmi Tax Deductible Credit Karma

Hazard Insurance Meaning Examples How It Works

Betterment Resources Original Content By Financial Experts App