Student loan forgiveness

Federal Student Aid. Student loan forgiveness for borrower defense to repayment.

Is Student Loan Forgiveness Biblical Christianity Today

Education Department published a.

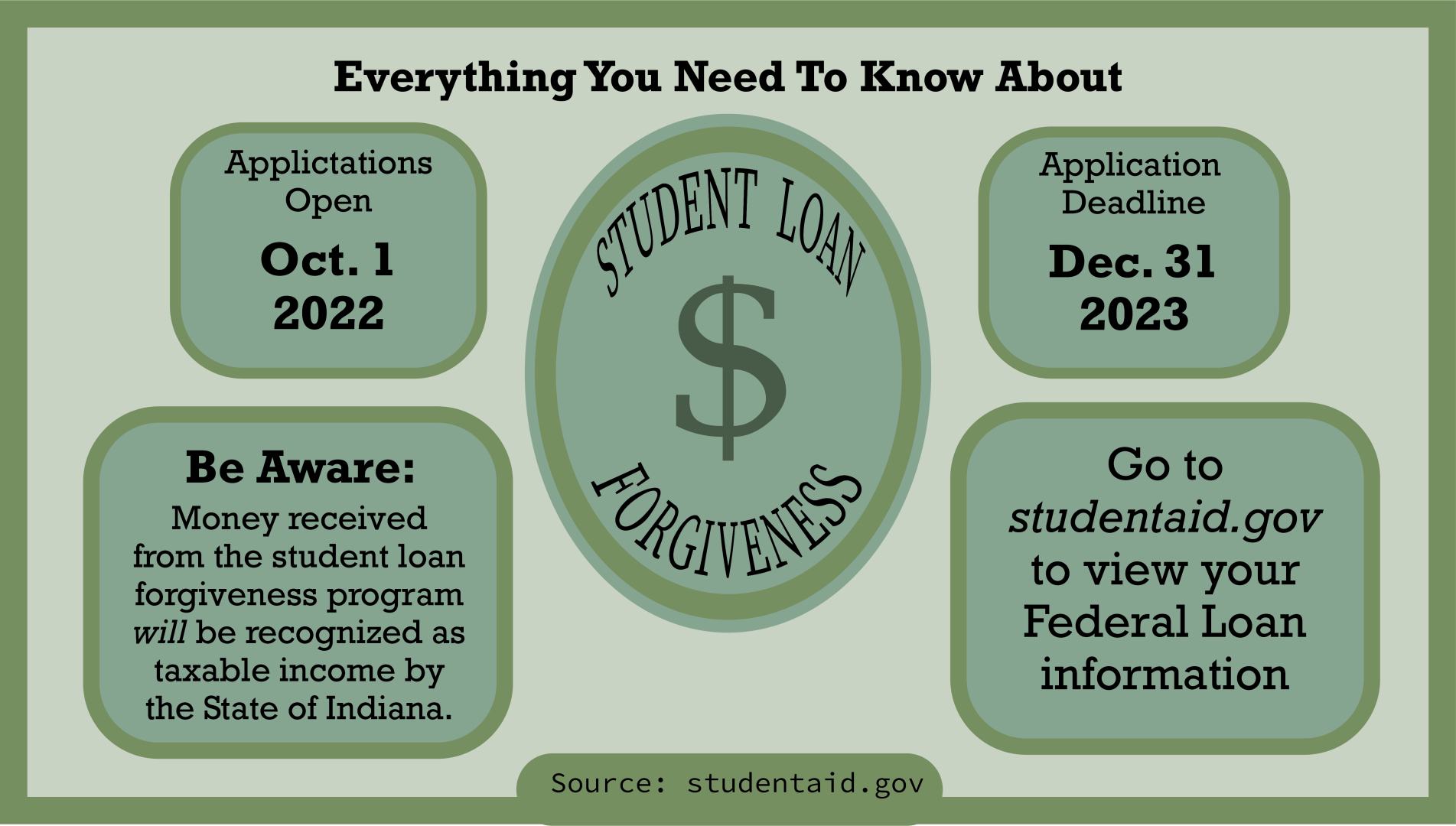

. On Thursday Supreme Court Justice Amy Coney Barrett decided not to get involved with Joe Bidens student loan forgiveness scheme denying a Wisconsin groups bid to block the order. In October 2021 the US. With the student loan forgiveness application officially live many borrowers are wondering if they will be taxed on their forgiven student loans as income.

FILE - President Joe Biden speaks about student loan debt forgiveness in the Roosevelt Room of the White House Aug. Bidens Student Loan Forgiveness Plan Included Path To Cancellation For Many Borrowers. Because of existing laws some states may tax borrowers who receive student loan forgiveness reports CNBC.

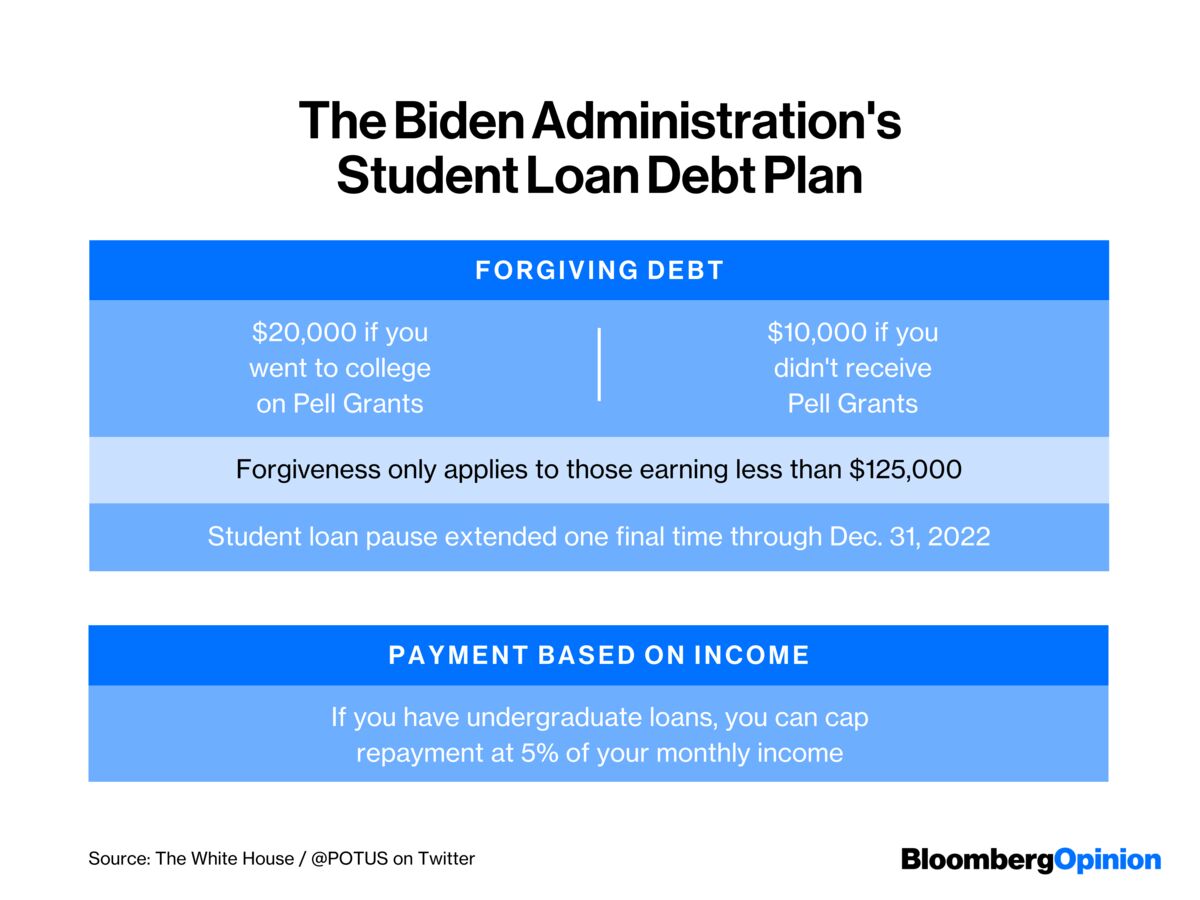

Department of Education announced a new limited waiver to help student loan. Only borrowers with federal loans are eligible for relief if their individual income is less than 125000 or 250000 for households. The White House plan to cancel 10000 to 20000 in student loan debt for borrowers earning 125000 or less per year could have a big impact on many American households -- about 43 million.

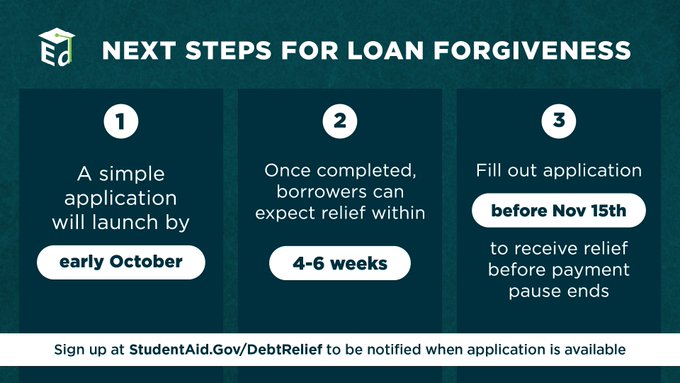

President Bidens student loan forgiveness application is now officially open and borrowers can begin applying for up to 20000 in debt cancellation. Latest on Student Loan Forgiveness. Federal Student Aid.

I already have a loan. 29 2022 are eligible for one-time debt relief. President Trump has offered to forgive some student loan debt as part of a new 18 trillion stimulus proposal to House Democrats indicating how rapidly the idea of cancelling student debt has.

President Joe Bidens decision on widespread student loan forgiveness will cancel at least 10000 in student loan debt. While most states do not tax loan. Life comes at you fast.

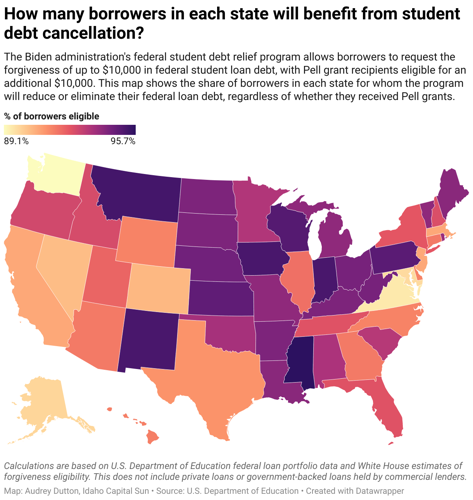

President Bidens student-loan plan would reduce or wipe out the debt of millions of borrowers. Student loan forgiveness wont trigger federal taxes but some states may recognize the cancellation as income. There are quite a few states that do not conform.

Biden has cancelled 15 billion of student loans for student loan borrowers through borrower defense to repayment. However there is still time for states to make changes to current policies. Heres what to expect in the student loan forgiveness application.

Millions and millions of peopleworking and middle class folkscan apply and get this. A small business advocacy group has filed a new lawsuit seeking to block the Biden administrations efforts to forgive student loan debt for tens of millions of Americans. Up to 10000 if they didnt receive a Pell Grant which is a type of aid.

The Biden administration increases efforts to fight student loan forgiveness scams The Biden administration is increasing its efforts to fight scams that take advantage of borrowers applying for. Since the start of the temporary changes the Department has approved more than 10 billion in loan discharges for 175000 public servants. Student loan forgiveness.

Until October 31 2022 you can apply for a limited waiver for student loan forgiveness. This limited waiver is a catch all waiver which allows you. That had liberals spiking the football suggesting that it wouldnt be possible for anyone to gain standing to challenge the presidents move.

To apply for forgiveness or payments to count toward forgiveness under the temporary changes visit the PSLF Help Tool. Though student loan forgiveness was considered non-taxable income through the American Rescue Plan passed in 2021 it was only on a federal level. Under the plan first announced in August President Joe Bidens one-time student loan cancellation.

Student loans have soared to 17 trillion. Public Service Loan Forgiveness Statistics. President Joe Biden announced in August that most federal student loan borrowers will be eligible for some forgiveness.

Borrowers with FFEL Program loans and Perkins Loans not held by ED who have applied to consolidate into the Direct Loan program prior to Sept. Student loan borrowers might get an automatic refund for their student loan payments if they voluntarily made payments during the COVID-19 student loan payment pause. 24 2022 in Washington.

Public Service Loan Forgiveness PSLF Teacher Loan Forgiveness Program. The loan forgiveness policy creates an incentive for borrowers to consolidate Federal Family Education Loans owned by MOHELA into Direct Loans owned by the government depriving them MOHELA. We tackled everything you need to know about the debt relief plan.

Who qualifies for student loan forgiveness. The Education Department announced Tuesday that it was discharging 15.

President Biden Announces Student Loan Forgiveness Abc News

Nd0exmpwwumyem

Conservatives Are In A Legal Battle To Stop Biden S Student Loan Forgiveness Npr

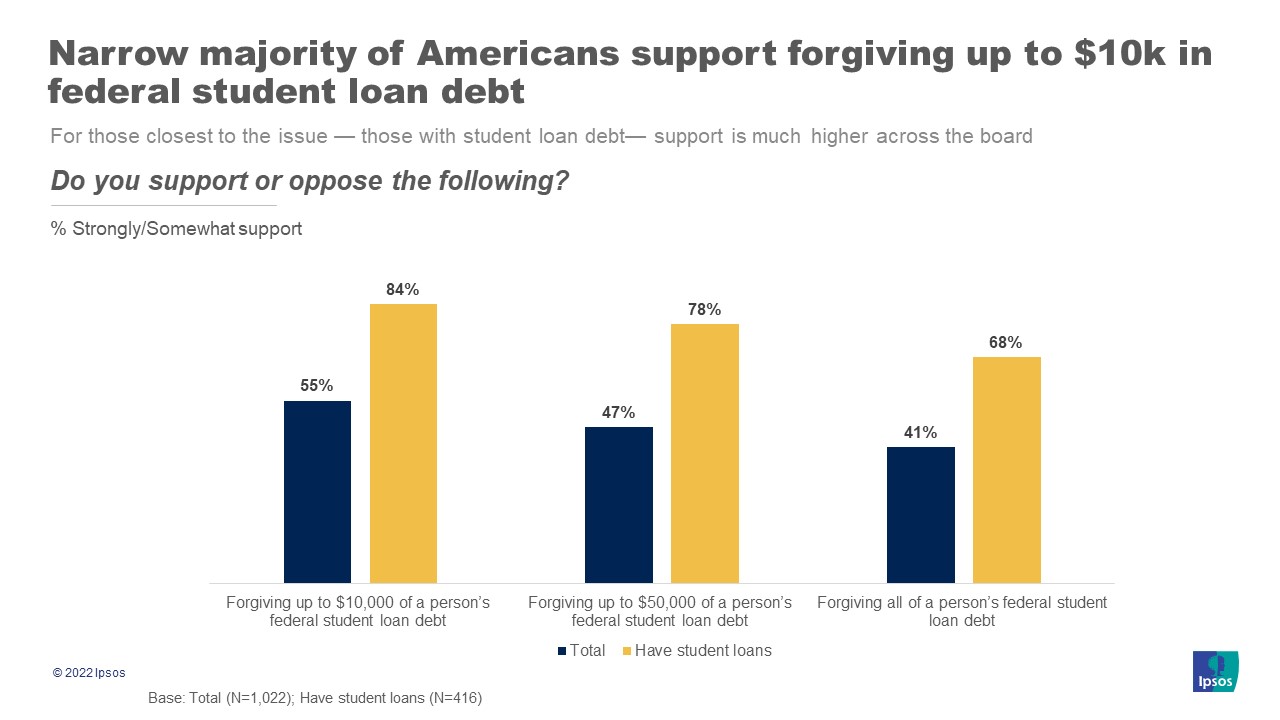

Support For Student Loan Forgiveness Varies Widely Between The American Public And Those With Loans Ipsos

Student Loans How To Prepare For Biden S Student Loan Aid Application Marca

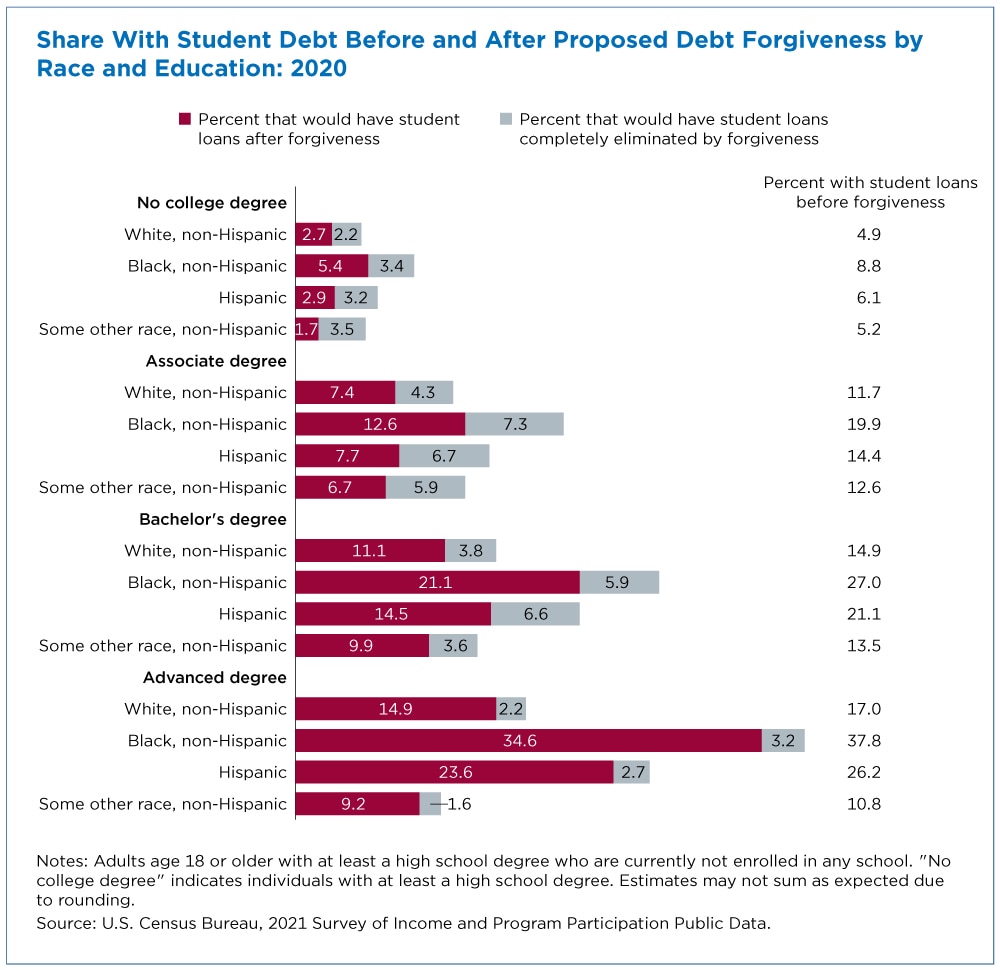

Who Is Impacted By Student Loan Forgiveness And How

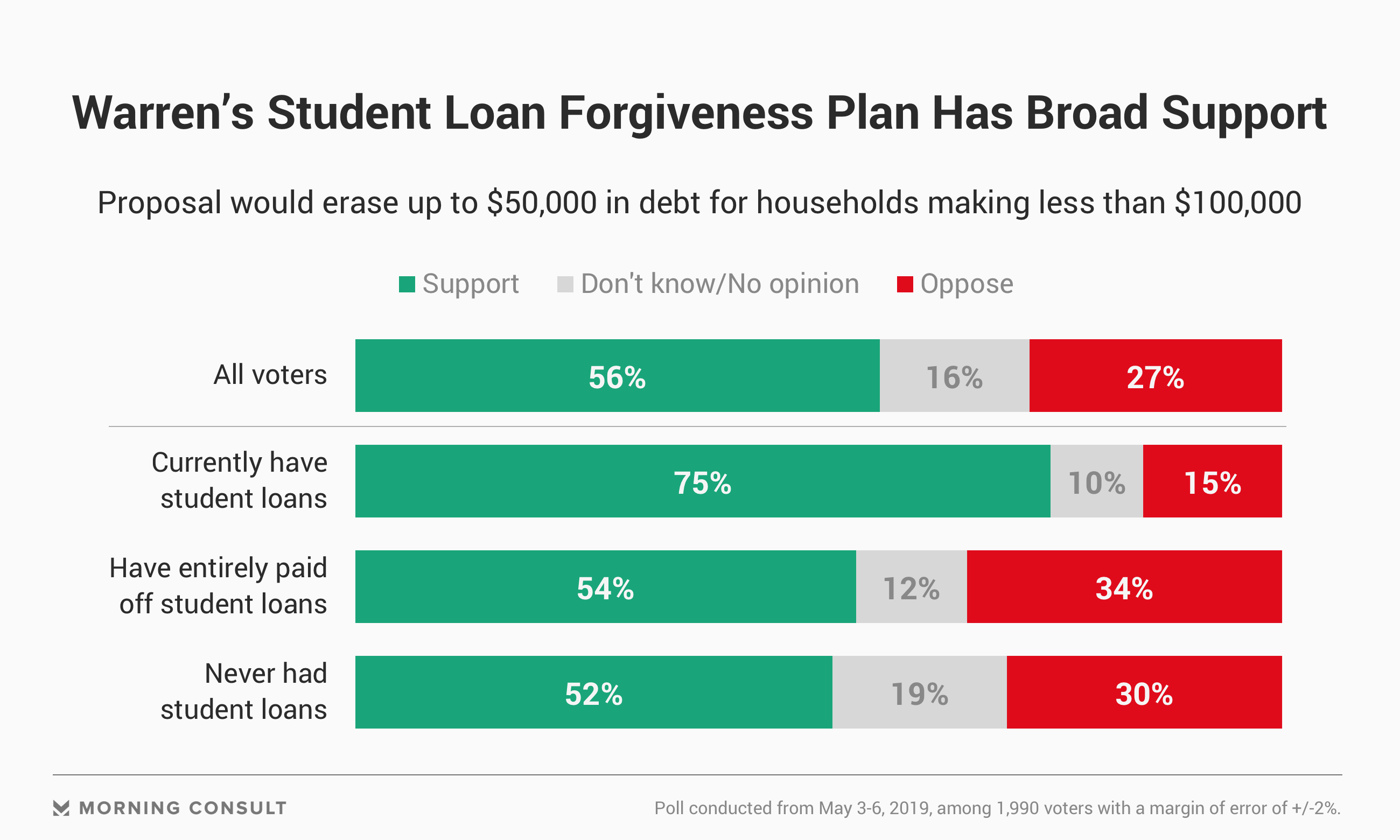

Elizabeth Warren S Student Debt Forgiveness Plan Popular With Voters

Thanks To Union Advocacy Student Loan Forgiveness Is A Reality

Student Loan Forgiveness Biden Plan To Cancel Debt Is A Costly Mistake Bloomberg

Student Loan Forgiveness Application Officially Launches

More Than 200 000 Student Debtors In Idaho To Benefit From Loan Forgiveness White House Says Education Mtexpress Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/DYMREY57BBAM7HF3VY34DD3SJY.jpg)

Application To Apply For Student Loan Forgiveness Is Set To Launch Next Month

Should I Apply For Student Loan Forgiveness Ramsey

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

What Student Loan Forgiveness Means For You Vox

President Biden Announces Federal Student Loan Forgiveness Plan The Reflector

Is The Student Loan Forgiveness Application Open Key Dates Steps Borrowers Can Take For Canceling Student Debt Abc30 Fresno

Explainer Do You Qualify For Biden S Student Loan Forgiveness Plan